Longtime readers may recall last March when I wrote about how I would be using our tax return to launch a “debt snowball” and pay off our car and student loan debt. I was excited, but also apprehensive about the idea–depending on only $1,000 in an emergency fund was scary, and I wasn’t sure if we would always be able to afford to throw the extra money toward debt instead of other expenses.

I didn’t know at the time that we would place our house on the market in the summer and buy a different, slightly more expensive home. Our finances became interesting fast as we readied our house for the market and paid for moving-related expenses. But somehow everything worked out and we never had to depart from our debt repayment plan.

I am so thrilled to be able to shout that

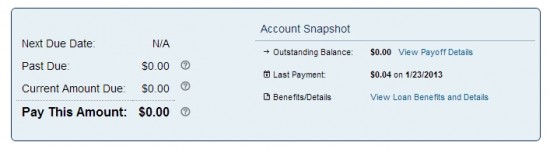

WE ARE OUT OF DEBT EXCEPT FOR OUR MORTGAGE!

Both my car and my student loans were paid off more than a year ahead of schedule, and now we can move on to our other financial goals earlier than expected. No more pining for 2014 when we would finally be able to live without debt.

How did we do it?

The debt snowball set things rolling, but our frugal lifestyle enabled us to keep things on track, even when the going got tough.

Cutting out luxuries

My husband and I agreed that we could do without extras like digital cable and expensive cell phone plans. I switched to basic cable (a very minor expense on top of the high speed internet that we decided we can’t do without), and we haven’t missed the hundreds of channels we used to have. For the past several years we have spent no more than $200 annually on our prepaid cell phones.

Careful planning

Meal planning in particular has really helped keep the grocery budget in check even when I was too busy and frazzled to think about using coupons. By heading into the grocery store with a list, I avoid wasting money on expensive items I don’t need. But couponing and stocking up when I had the time and energy greatly helped, too–when things got really hectic, I saved time and money by dipping into my stockpile of household goods and canned foods.

Extra income

I earn a very small amount from blogging, but the extra income helped offset the cost of birthday gifts and other expenses, like a new vacuum cleaner. I also sold unneeded items through eBay, Craigslist and garage sales. My husband is fortunate to receive paid overtime, and that greatly helped as well. Sometimes we just needed a little extra boost to make sure we could get by without using savings or halting our debt payoff plan.

What’s next?

We are working through Dave Ramsey’s Seven Baby Steps to build wealth and ensure a secure financial future. We have checked off steps one and two, and now it’s time to tackle step three: saving up a full emergency fund. We are aiming to save six months of living expenses, including the cost of COBRA (yikes!), so that we will be prepared for the worst-case scenario, a job loss.

I have set up an automatic savings plan so that each month the money that would have been spent on debt will now go straight to our emergency account. I’m happy we will have the money to save, but right now this goal seems almost insurmountable–I’ve estimated that it will take nearly three years! Still, every time we tuck money away into savings, we will be better off than we were before, and that’s something to feel good about. We are paying ourselves now, not some bank. I hope that once we get the ball rolling we will find ways to streamline our budget further and bring in some extra income to help achieve this steep goal more quickly.

Financial Peace

Dave Ramsey’s Total Money Makeover was just what I needed to help me change my attitude about money and think outside the box to accomplish goals. I was fortunate to be able to review his Financial Peace University Course for a guest post on Frugal Mama. I think the added detail and structure provided by the classes will give me even more confidence and motivation, and help my husband and I work together as a team. Learn more about my experience with Financial Peace University here.

Dear Jen,

I loved hearing this exuberant story about how you demolished all your non-mortgage debt. I especially loved hearing about how your frugal living practices helped you stay on track, even when large expenses threatened to derail you. It’s great to hear real life stories about how living simply and carefully can help people achieve their dreams.

Thanks for the wonderful review on my blog of Dave Ramsey’s program.

Amy

Thank you, Amy! I really enjoyed doing that review.

Hi, Jen. I am a new follower. I found you through a comment you left on Frugal Mama’s website today. My husband and I have only our mortgage debt, too, and we just recently decided to pay it down faster. Congratulations! It’s a wonderful feeling to have those debt burdens lifted. Good luck building up your emergency fund. That’s another goal we have. I look forward to your posts. 🙂

Thank you so much for visiting, Kathryn! It really is freeing being able to make our own decisions about what to do with our money. Good luck to you and your husband as you work toward your goals!